Thorsten Goebel

Thorsten Goebel

Articles de blog de Thorsten Goebel

Gold isn't subject to the identical volatility as stocks and different investments, making it a safe haven on your cash. A silver IRA can be a conventional IRA, a ROTH IRA, a SEP-IRA, a Simple IRA, or and Inherited IRA that is self-directed by the account holder and owns allowable types of bodily silver coins or silver bars. Moreover, they provide storage insurance coverage so that any losses resulting from theft or injury are covered by their specialised workforce of security professionals who monitor buyer portfolios across the clock. In the event you adored this post as well as you would want to obtain details relating to gold and silver ira i implore you to stop by our own web-site. Lastly, Noble Gold additionally presents safe storage options if needed; clients who opt for these companies can relaxation assured understanding their investments are safe from theft or harm due to fireplace or other disasters. If that nonetheless is not enough to provide investors pause, we are additionally troubled by what we found when looking into some of the people who find themselves aggressively advertising and marketing the "home storage" IRA scheme. I have a retirement plan at work. Annual charges for self-directed IRA custodian accounts sometimes range between $200 and $500, including transaction fees (e.g., examine writing) and custodian-to-custodian switch fees.

Gold isn't subject to the identical volatility as stocks and different investments, making it a safe haven on your cash. A silver IRA can be a conventional IRA, a ROTH IRA, a SEP-IRA, a Simple IRA, or and Inherited IRA that is self-directed by the account holder and owns allowable types of bodily silver coins or silver bars. Moreover, they provide storage insurance coverage so that any losses resulting from theft or injury are covered by their specialised workforce of security professionals who monitor buyer portfolios across the clock. In the event you adored this post as well as you would want to obtain details relating to gold and silver ira i implore you to stop by our own web-site. Lastly, Noble Gold additionally presents safe storage options if needed; clients who opt for these companies can relaxation assured understanding their investments are safe from theft or harm due to fireplace or other disasters. If that nonetheless is not enough to provide investors pause, we are additionally troubled by what we found when looking into some of the people who find themselves aggressively advertising and marketing the "home storage" IRA scheme. I have a retirement plan at work. Annual charges for self-directed IRA custodian accounts sometimes range between $200 and $500, including transaction fees (e.g., examine writing) and custodian-to-custodian switch fees.

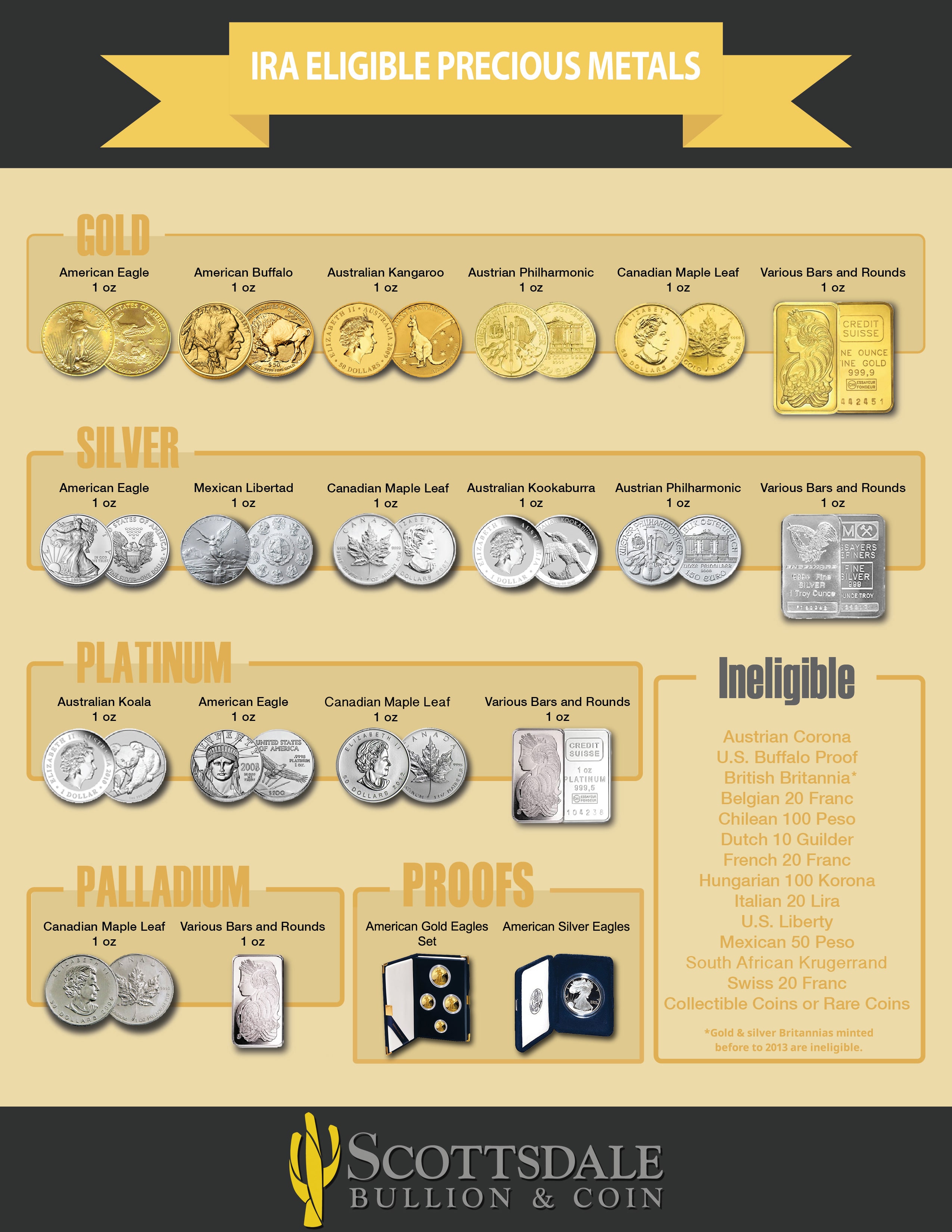

You can also discover out what individuals are saying about their experiences with the dealer online - on the BBB's website and elsewhere. Enterprise research research frequently discover and report that during times of financial uncertainty, investors have a higher propensity to react extra rapidly to "bad news" than they do to "good news." This explains why the hazard of a market rush or panic is greatest when financial occasions of uncertainty are overlapped by sudden adverse occasions. Many individuals can even discover such a facility close to dwelling. Some miners say the official National Union of Mineworkers is just too close to the governing African National Congress (ANC) and so is now not standing up for their rights. By submitting this request, you verify that Rosland Capital may ship you the free information checked above, and that you're expressly authorizing Rosland Capital to contact you at the e-mail deal with and/or phone number above, together with a mobile phone, and to ship you SMS messages (including text messages) with marketing offers, irrespective of whether or not or not such phone quantity appears in any state or nationwide Do not Name registries. Bars, rounds, and coins should be produced by a refiner, assayer, or producer that's accredited/certified by NYMEX, COMEX, NYSE/Liffe, LME, LBMA, LPPM, TOCOM, ISO 9000, or nationwide government mint.

You can also discover out what individuals are saying about their experiences with the dealer online - on the BBB's website and elsewhere. Enterprise research research frequently discover and report that during times of financial uncertainty, investors have a higher propensity to react extra rapidly to "bad news" than they do to "good news." This explains why the hazard of a market rush or panic is greatest when financial occasions of uncertainty are overlapped by sudden adverse occasions. Many individuals can even discover such a facility close to dwelling. Some miners say the official National Union of Mineworkers is just too close to the governing African National Congress (ANC) and so is now not standing up for their rights. By submitting this request, you verify that Rosland Capital may ship you the free information checked above, and that you're expressly authorizing Rosland Capital to contact you at the e-mail deal with and/or phone number above, together with a mobile phone, and to ship you SMS messages (including text messages) with marketing offers, irrespective of whether or not or not such phone quantity appears in any state or nationwide Do not Name registries. Bars, rounds, and coins should be produced by a refiner, assayer, or producer that's accredited/certified by NYMEX, COMEX, NYSE/Liffe, LME, LBMA, LPPM, TOCOM, ISO 9000, or nationwide government mint.

However, the coins or bullion should be held by the IRA trustee or custodian slightly than by the IRA proprietor. And they could attempt to sell you some of their overpriced "proof" coins to carry within the account. Moreover, many corporations additionally impose ongoing charges and/or fee expenses associated with maintaining these accounts - so it’s always clever to analysis any potential prices forward of time before committing to something. Finally, different potential prices which ought to be factored into your calculations include storage fees (should you opt for safe third-celebration vaulting) and dealing commissions when buying and selling securities throughout the account. However just about any conventional IRA, whether Roth or traditional, may be converted to a self-directed account. A Gold IRA might be a standard IRA, a ROTH IRA, a SEP-IRA, a Easy IRA, or and Inherited IRA that is self-directed and owns IRA eligible bodily gold coins or gold bars.

A Precious Metals IRA is just a conventional, ROTH, SEP, Easy, Rollover, or Inherited IRA that owns precious metals and may include gold, silver, platinum, or palladium. In case you have a precious metals IRA, your IRA instantly owns physical bullion bars or coins that you choose and order straight. Upon completion of the transfer, Gold and Silver IRA Noble Gold Investments will help customers in choosing which sorts of valuable metals they wish to put money into - together with gold coins and bars in addition to platinum and palladium products - earlier than serving to them place orders accordingly. This firm has been among the premier providers of valuable metallic investments since 1974, and they provide a wide range of products together with coins, bars, rounds and extra. To sum up, discovering the correct gold IRA company requires doing a little due diligence beforehand - researching registration particulars, studying customer reviews online and comparing fees throughout completely different providers - but being thorough upfront will help protect your investments down the line and probably yield better rewards too! You may even need to match rates between different providers for similar products before settling on one choice particularly.

With no commissions charged, this company stays some of the price-effective methods to diversify your portfolio as we speak. When it comes to taxation of a Gold IRA, there are two foremost types: pre-tax contributions and after-tax investments. A rollover is usually accomplished when transferring between two totally different accounts resembling from a 401(k) to an IRA. As soon as the account is opened, clients can switch funds from any present IRA or 401(okay) into their new gold IRA account. As a rule of thumb, you may make this "rollover" if you are no longer employed by the sponsor of your 401(k). If you're nonetheless working for the agency sponsoring your plan, you can be restricted to the investment options they've chosen for you. For starters, since your whole transactions inside the account are thought of long run investments, they won’t be subject to brief term capital positive factors rates-which may vary anyplace from 10% - 39%. As a substitute, the profits made by means of investing in valuable metals like gold inside an IRA are eligible for preferential long term capital beneficial properties therapy if held longer than 12 months (typically 15%). This means any profits taken out of the account during retirement could probably qualify for decrease taxes compared to different sources of earnings resembling wages or Gold and Silver IRA dividends paid by stocks and bonds.